What is InvoiceNow?

InvoiceNow allows direct transmission of invoices in structured digital format from one finance system to another using the Nationwide E-delivery network, which is based on Peppol, allowing for the invoice to be flipped to E-payments such as Paynow directly

I am already using PDF E-Invoice, why is InvoiceNow different?

In a common business scenario today, an PDF e-invoice is sent to the recipient organisation by email. This is a single-sided operation requiring your recipient to re-enter the details of the invoice into their own accounting system (e.g. accounts payable). A more complete solution should include the transmission of data from supplier system to buyer system without human intervention and potentially allow for the InvoiceNow invoice to be paid seamlessly.

Is InvoiceNow a form of Electronic Data Interchange (EDI) e-invoice?

Yes, InvoiceNow is a type of Electronic Data Interchange (EDI) based on the Peppol standards. Additionally, the Peppol network complements companies’ existing EDI connections to allow e- invoicing to businesses connected to the Peppol network.

What is Peppol?

Peppol is an international E-Document delivery network and business document standard form of Electronic Data Interchange (EDI) allowing enterprises to digitally transact with other linked companies on the Network.

Is InvoiceNow e-invoicing different from Peppol e-invoicing?

No, InvoiceNow e-invoicing is based on the Peppol business document standard and operates over the Peppol network and allowing enterprises to digitally transact with other linked companies on the Network

Are consumer invoices covered under InvoiceNow?

No, InvoiceNow only covers business to business transactions. Business to consumer transactions are currently not covered.

How will InvoiceNow work with other Electronic Data Interchange (EDI) solutions?

InvoiceNow on Nationwide E-delivery Network complements your existing EDI connections to allow e-invoicing to businesses connected to the Peppol network. This extends the reach of digital connections that you can access via your existing solutions to new segments.

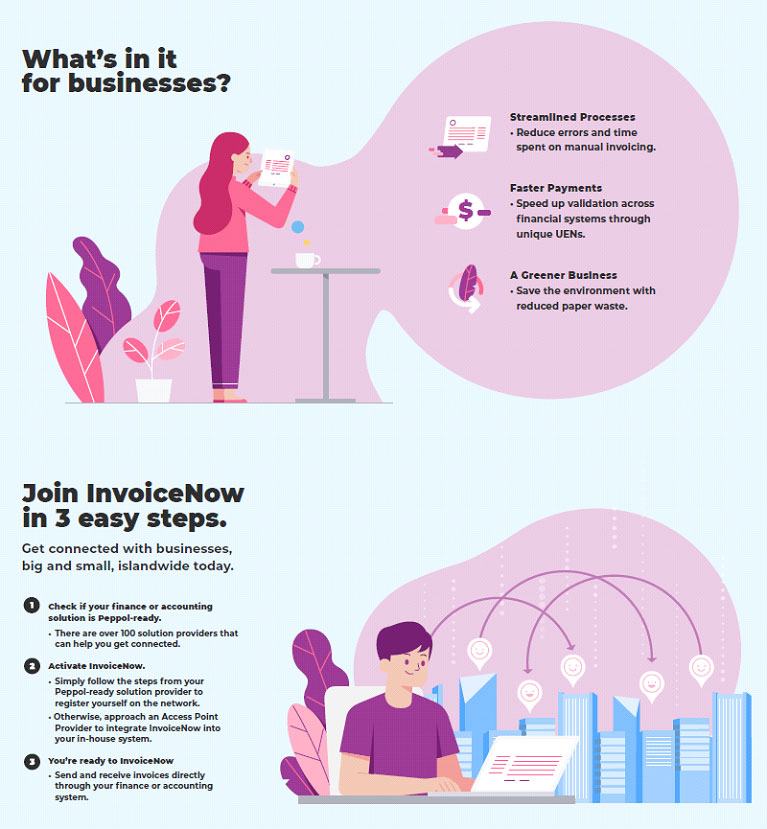

How can InvoiceNow e-invoicing help save cost?

- Faster payment of Invoices due to simplification of Invoice to Payment processes. Several banks are working on solutions that allow users to directly flip an InvoiceNow einvoice to an E-Payment.

- Reduction of tedious and time consuming manual processes (estimated $8 per invoice according to a study commissioned by IMDA)

- Reduction of errors and rectification costs (estimated to affect 3% of paper invoices and costing as much as S$72 to rectify, according to a study commissioned by IMDA).

- Reduction of storage, retrieval and delivery costs.

If my supplier and/or client is not on the network, will I still enjoy the benefits?

To benefit from the network, users (i.e. senders and receivers of invoices) must be registered on the network. Just like emails, there’s a need for each to be registered and have a Peppol- ID that partners can send InvoiceNow e-invoices to.

Is there a monetary benefit for end-user companies coming on board? Or are there only non- monetary benefits such as faster payments?

Though getting paid earlier and improvements to efficiency and are clear monetary benefits. Having a digital connection for B2B document exchange is also a good first step to further digitalisation.

For other FAQ, refer to IMDA website

Register for IMDA monthly business briefing webinar to find out more about InvoiceNow and how your business can come-on-board the network, start to transact and begin to enjoy the benefits.

To find out more about InvoiceNow, visit https://www.imda.gov.sg/programme-listing/nationwide-e-invoicing-framework

To watch a Video about InvoiceNow at https://go.gov.sg/invoicenow-video